It is an unfortunate reality that financial hardship has hit many Canadians during the Covid-19 crisis. For those who have never experienced the burden of financial distress, it may be difficult to know what your options are or who can provide you with enough information to help you get through it. There are many different companies and firms that offer help when it comes to debt solution, such as Licensed Insolvency Trustees and debt relief consultants. But what are debt relief consultants and are they a viable solution for overcoming your financial hardships? Below you will find all the information you need to know, so that you may be able to find the most successful recourse for your personal debt solution.

Debt Relief Consultants and the Services They Offer

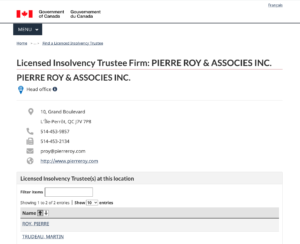

Pierre Roy & Associés holds a Licensed Insolvency Trustee license with the Office of Superintendent of Bankruptcy of Canada

Many who are struggling financially will research ways in which they can better their situation. In doing so, they may fall on websites that offer debt relief counselling. These services seemingly range from help in managing your money so that you can pay off your debt to legal solutions like consumer proposal and personal bankruptcy. Oftentimes, the options that are suggested seem too good to be true. But as is usually the case, if it seems like it’s too good to be true… it probably isn’t true.

The real issue that surfaces when dealing with debt relief consultants is that they are not regulated by the federal government. This means that there is the potential for a lot of scams to take place. And when looking for solutions to your debt, the last thing you want is to be scammed into an even more precarious financial situation.

The safest option to go with is always one that is regulated by the federal government, such as Licensed Insolvency Trustees.

Licensed Insolvency Trustees vs Debt Relief Consultants

Although they both claim to provide the same services, there are many things that separate the two.

1. First, in order to become a Licensed Insolvency Trustee (LIT), you need to undergo special education and training. Debt consultants, on the other hand, don’t require any of this. In fact, anyone can try their hand at becoming a debt consultant. This is why debt consultants are not authorized to file consumer proposals or bankruptcies (as these are legal filings), even though they may claim that they can. In these cases, what usually ends up happening is that debt consultants will charge you exorbitant consulting fees only to redirect you towards a Licensed Insolvency Trustee who could have offered you a first consultation free of charge.

2. Second, the unfortunate reality of many of those who are currently dealing with debt is that they are also dealing with incessant phone calls from their creditors or collection agencies. Involving yourself with a debt consultant will not put an end to those phone calls. Only Licensed Insolvency Trustees can provide you with protection from harassment, legal procedures and garnishments.

A Licensed Insolvency Trustee is the only professional who can bring all your creditors to the negotiation table.

3. Finally, being on the hunt for debt relief often means that you are going to have to come to an agreement with your creditors. Where participation in your debt relief options is mandatory with a Licensed Insolvency Trustee, it is only voluntary with debt consultants. If creditors refuse to work with the debt consultant, the debt consultant may still charge you fees for their time.

This isn’t to say that all debt consultants are bad — some might even provide decent services and good advice. However, the likelihood of falling on a debt consultant that will worsen your financial situation is much greater than if you were to deal with a Licensed Insolvency Trustee. The key to achieving financial stability is to ensure that you are getting the right advice from professionals who are qualified (and licensed!) to give it.